The stark reality of life under coronavirus lockdown is dawning on investors

Canada, Italy, France, Spain — and on Tuesday, the entire 26 nation trading bloc of the European Union — have shut down their external borders in a desperate bid to control the worldwide spread of coronavirus infections.

With Italy — Europe’s worst hit country — forced to take even more stringent measures to keep people off streets, could the U.S. be next? If so, are its citizens prepared to bear the draconian protocols it might require to beat back the scourge of COVID-19?

Already, New York City is preparing for the possibility of a “shelter in place” order that would virtually confine citizens to their homes, the world’s largest economy is moving incrementally toward a nightmare scenario that makes investors’ blood run cold.

Although stocks rallied on Tuesday in response to massive stimulus plans being debated in Washington, the stark reality of life under lockdown is just starting to dawn on investors, and the public at large.

Recently, Fundstrat’s Tom Lee warned of two scenarios involving the COVID-19 pandemic. The disease’s rapid diffusion might require governments to either “resort to a form of martial Law, which drives the world in recession,” or the coronavirus’ unchecked spread “kills consumer confidence sufficiently to drive a recession worse than 2008.”

The latter suggestion is seemingly underway, as Wall Street’s base case for global growth has metastasized from brief downturn to full-fledged recession.

Yet ironically, it took a “martial law” outcome for China to drastically bend the curve of soaring infections, and get people back to work.

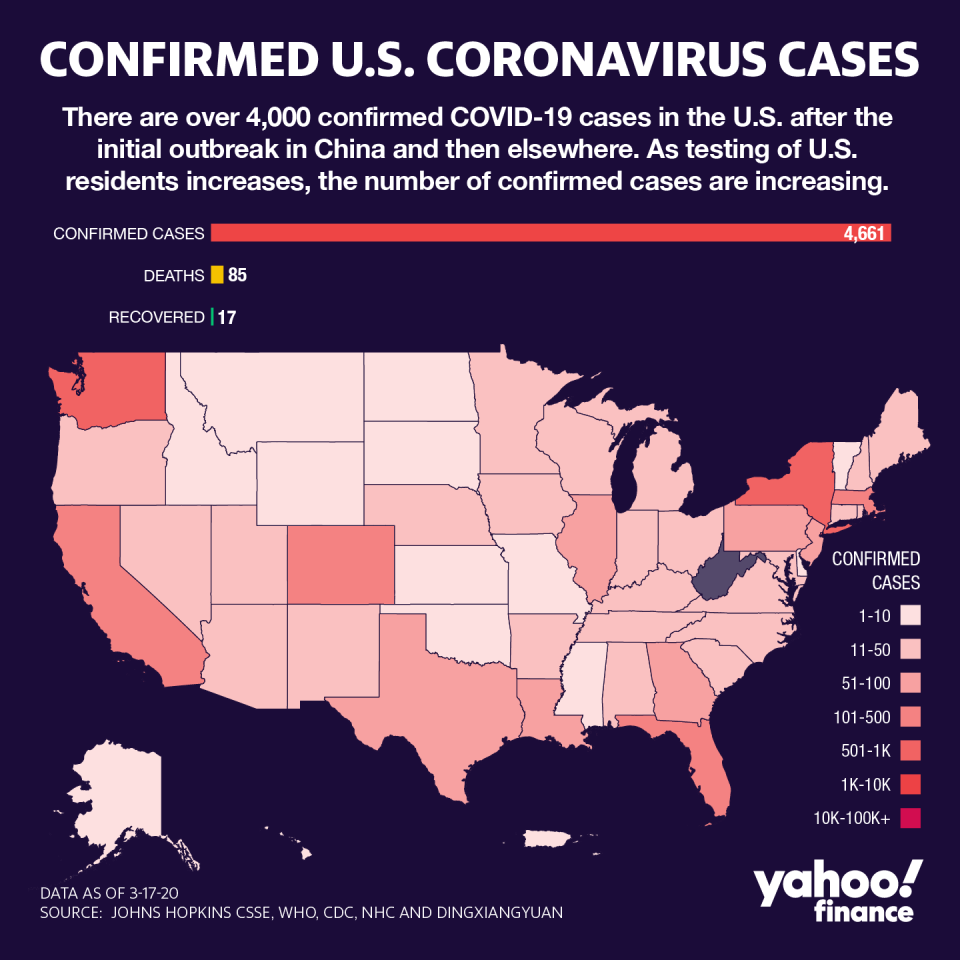

And as the U.S.’s infection count rises dramatically, it may only be a matter of time before the U.S. follows its global cohorts into a complete shutdown that would confine people to their homes, empty streets even further — and may even block domestic travel.

It raises serious questions about whether Americans — accustomed as they are to unrestricted movement and other cherished freedoms — are conditioned to deal with the extreme measures it would take to beat the coronavirus.

🚔 “Your actions are jeopardizing public health.” – New Orleans Police as they clear crowds from Bourbon Street. #coronavirus pic.twitter.com/Q2T0M5WrcC

— Brantly Keiek (@BrantlyWx) March 16, 2020

Thus far, evidence suggests the public isn’t exactly rising to the challenge. A new Harris Poll found that 74% of Americans are afraid of accidentally spreading the virus to vulnerable people even if they are asymptomatic — but they’re not changing their daily patterns to actually mitigate risk to other people.

Clearwater Beach, Florida is PACKED today despite "social distancing" recommendations. https://t.co/WzGydcP1Ja pic.twitter.com/vsRD4QLbhr

— WFLA NEWS (@WFLA) March 16, 2020

“I don’t think we are prepared to deal with the kind of restrictions that China placed on many of its citizens,” University of Houston law professor Seth Chandler told Yahoo Finance in a recent interview.

Chandler referred to what the world’s second largest economy did after Wuhan, China, became the epicenter of an explosion in coronavirus infections. Haunting video taken at the time captured a desolate city virtually devoid of pedestrian or vehicular traffic, as the Chinese government —which maintains an iron grip on public life and speech — enforced a strict quarantine.

“While we do have good laws and we do have well-meaning people, we do still have an attitude that respects freedom and choice, which is normally a good thing,” Chandler told Yahoo Finance. However, “I’m not sure how willing we are to shut down our economy,” he added.

‘A horrifying picture’

In ways big and small, those restrictions are already taking place. Public life in major cities like the Big Apple and San Francisco is being sharply curtailed to prevent coronavirus spreading.

The idea of the U.S. restricting cherished freedoms is one of the reasons why markets have been so tumultuous lately.

It’s also why investors and economists — who have been forced to become epidemiologists and pathology experts on the fly — are increasingly restive over the idea of curtailing economic activity in ways that fundamentally alter American life.

Market veteran David Zervos of Jefferies Financial said this week that Italy’s mounting COVID-19 casualties were “painting a horrific picture for what is likely in store for the rest of Europe and the U.S.” — both of which are now fighting an uphill battle to mitigate the virus’ spread.

“Personally, these numbers have me more stressed than after 9/11, or certainly anything during 2008/09,” he added.

Against that grim backdrop, Dec Mullarkey, managing director at SLC Investment Strategy at SLC Management — the money-management arm of insurer Sun Life Financial that oversees $160 billion in assets — thinks Wall Street has been “acting pretty rationally” as it attempts to price in the unknown.

“Unequivocally what the market is struggling with is this void of information,” he told Yahoo Finance in an interview last week. “And what we’re getting is really high frequency updates on infection rates, and people are reacting to that.”

Most on Wall Street initially expected a fairly narrow recession followed by a sharp upturn in growth — the classic “V-shaped recovery.” However, “repricing shifted when [the coronavirus] breached China and moved into South Korea and Italy,” Mullarkey said.

“Now what they’re repricing is there’s been a narrative that it's similar to flu and rate of contagion but is very different from the flu,” he added.

University of Houston’s Chandler called for a response to the outbreak that would be the functional equivalent to World War II’s Manhattan Project, the U.S.-led effort to create an atomic bomb, saying that “rational fear will paralyze an economy.”

Moreover, it might not be just two weeks of hunkering down. So long as the virus keeps bubbling up…”the economy will be seriously depressed and social norms may change greatly,” he told Yahoo Finance.

Yahoo Finance’s Anjalee Khemlani contributed to this article.

Javier David is an editor for Yahoo Finance. Follow him on Twitter: @TeflonGeek

Read more:

Wall Street cites Sanders as a rival to the coronavirus as a market risk

Investors bet on Sanders after New Hampshire win as Biden plummets: Smarkets

Biden overtakes Trump on betting markets as coronavirus pandemic undermines president

Trump reelection odds 'better than even,' may top 2016 despite impeachment: Eurasia

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finanzas

Yahoo Finanzas